M-Pesa appeared as a groundbreaking innovation, fundamentally altering the financial landscape in underserved nations. This mobile money platform, first introduced in Kenya, has since expanded to numerous countries, empowering thousands of individuals with access to financial services like transactions. By leveraging the widespread availability of mobile phones, M-Pesa democratizes to banking, promoting economic growth and financial inclusion.

The success of M-Pesa has stimulated a global trend in mobile money adoption.

Various other providers have invested the market, presenting diverse services tailored to specific regional needs. From remittances to microloans, mobile money has evolved into a comprehensive tool for financial development.

The future of finance is undeniably digital. As technology progresses, we can expect even greater levels of connection between mobile money and traditional financial institutions. This will further transform the global financial landscape, making it more equitable for all.

Empowering the Unbanked: Fintech's Influence on Digital Financial Inclusion

Fintech is revolutionizing the financial landscape by providing innovative solutions to traditionally underserved populations. Through mobile banking, peer-to-peer lending platforms, and digital payment systems, fintech companies are breaking down barriers to access and empowering the unbanked. By leveraging technology, these platforms offer a range of services, such as savings accounts, microloans, and insurance products, all tailored to meet the specific needs of individuals in emerging markets or with limited financial history.

The rise of fintech has fostered financial inclusion, enabling millions to participate in the global economy and unlock their full potential. Additionally, these digital platforms promote transparency, efficiency, and affordability, creating a more equitable and inclusive financial system for all.

M-Pesa: A Case Study in Mobile Money Innovation

M-Pesa has revolutionized mobile payments across Africa by providing a secure and convenient platform for transferring money. As a groundbreaking service, M-Pesa has empowered millions of individuals in underdeveloped economies, bridging the gap between the unbanked. Its impact has been widely celebrated, establishing M-Pesa as a example for mobile money innovation worldwide.

The platform's success can be explained by several key drivers. Firstly, M-Pesa's ease of use made it understandable even to individuals with limited digital experience. Secondly, the robust distribution network of merchants ensured that M-Pesa solutions were readily available in underserved areas. Thirdly, M-Pesa's protection protocols instilled confidence in users, mitigating concerns associated with mobile transfers.

These factors, combined with a effective marketing approach, have propelled M-Pesa to become a mainstream service in Africa.

Its expansion has gone beyond simple money disbursements, encompassing a variety of financial services such as loans, protection schemes, and even utility settlements. This diversification has strengthened M-Pesa's position as a vital pillar of the African financial ecosystem.

Digital transformation in finance

The banking sector is undergoing a rapid evolution, driven by cutting-edge advancements. Customers are increasingly seeking seamless, efficient banking services. This trend is propelled by a liferation in digital banking platforms, which are disrupting the traditional structure.

- Artificial intelligence (AI) and machine learning are optimizing operations, enhancing client experience.

- copyright platforms are rising in popularity as secure and transparent solutions for financial transactions.

- API-driven finance are facilitating the sharing of financial data, leading to financial inclusion.

The transformation of the industry is full of opportunity. As the industry adapts, we can expect a more inclusive financial landscape that benefits all stakeholders.

Unlocking Financial Access: How Digital Banking is Transforming Economies

Digital banking has become a powerful force in shaping the financial landscape, particularly for underserved populations. Previously, access to financial services was often limited by geographic location or socioeconomic status.

However, with the rise of mobile and online banking platforms, individuals can to manage their finances remotely, opening a world of opportunities.

This increased access to financial tools empowers entrepreneurship, enables financial growth, and fosters greater economic inclusion.

Furthermore, digital banking promotes innovation within the financial sector, leading the development of new products and services tailored to the evolving needs of customers.

As technology continues to advance, digital banking is poised to accelerate its transformative impact on economies globally.

It has the potential to bridge the financial gap, promoting sustainable development and inclusive growth for all.

Bridging the Gap : M-Pesa and the Democratization of Finance

M-Pesa, a mobile money transfer service launched in website Kenya, has emerged as a transformative force redefining the financial landscape. By providing inclusive financial services to individuals often excluded from traditional banking systems, M-Pesa enables economic participation and promotes inclusive growth. Its success has sparked a global movement toward financial inclusion, demonstrating the potential of mobile technology to bridge the gap between the financially included and the financially excluded.

- Leveraging M-Pesa, individuals can transfer money, execute payments, obtain microloans, and even purchase goods and services. This expansion of financial tools has had a profound influence on the lives of millions, particularly in developing countries.

- Additionally, M-Pesa has catalyzed entrepreneurship by offering access to capital and new markets. By simplifying financial transactions, it has minimized the cost of doing business and enabled small businesses to thrive.

Therefore, M-Pesa stands as a compelling example of how technology can be utilized to create a more inclusive financial system. Its success story underscores the urgent need for continued innovation and collaboration in the pursuit of universal financial access.

Charlie Korsmo Then & Now!

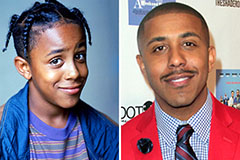

Charlie Korsmo Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!